Give Back, for Humanity –

Donate your

Tax Credit

Thank you for choosing to donate ${{ donationAmount }} NZD to Give Back, for Humanity.

- {{ error }}

Oh no! Something went wrong!

We’re sorry but we were unable to process your online donation.

We would love to receive your gift to help those in need!

So we can help process your donation please give us a call on 0800 733 276 or email us fundraising@redcross.org.nz. Our Supporter Care team are available Monday to Friday 9am-5pm.

If you would like to make a donation in a more convenient way for you find out how here www.redcross.org.nz/support-us/about-donating/how-to-donate/.

Thank you so much for your donation!

Your gift will help New Zealand Red Cross be prepared to respond and support vulnerable people where the need is greatest – both here in Aotearoa New Zealand, and around the world.

Give Back, for Humanity – donate your tax credit and make your support go even further.

Claiming and donating your tax credit to New Zealand Red Cross is a simple way to make your original donation go even further.

Do you know you could be eligible to claim 33 percent of your donations back from the IRD? You can make your impact even greater by donating your credit today.

Just imagine how much more impact your donation could have to help those in need.

It could provide essential supplies in times of disaster, help deliver nutritious meals to our vulnerable neighbours, or fund training for Disaster Welfare and Support Teams.

Please consider donating your credit to New Zealand Red Cross.

Donate what you claim back or choose your donation amount from the options above.

There are two ways you can choose to donate your tax credit:

1. Donate your estimated tax credit now. If you’d like to make an immediate impact, you can donate the estimated amount of your tax credit today.

2. If you prefer to wait, you can donate your tax credit after you receive it from IRD. You can apply for your donation tax credit from IRD by following the steps below. If you haven’t already, you could be eligible to claim for up to four years’ worth of donations. Once IRD processes your application, you can then choose to donate it back to New Zealand Red Cross.

Thank you for your generosity. Your donation will make an even greater impact where the need is greatest.

Donations over $5 are tax-deductible, allowing you to claim 33.3 percent back from the IRD.

Donating via internet banking

Account name: NZRC Fundraising

Account number: 12-3192-0043737-00

Particulars (Limited to 12 characters): Your first name or initials and surname or organisation name.

Code: Tax Credit

Reference: Your supporter ID number if known. You will find this number on correspondence from Red Cross, it starts with “RE"

OR

Include your phone number if you don’t have a supporter ID number.

Tax Receipts

- To receive a tax receipt email fundraising@redcross.org.nz after you have made the donation.

- Tell us your name, email, phone number, amount donated, and date deposited.

- We will email you a receipt.

- If you need us to post you a receipt, please tell us your address.

How to claim or regift your tax credit through IRD

You can claim your tax credit back online or by post.

For claiming online you will need a myIR login (www.myir.ird.govt.nz) or alternatively, a RealMe login (www.realme.govt.nz).

1. Sign in to your myIR account

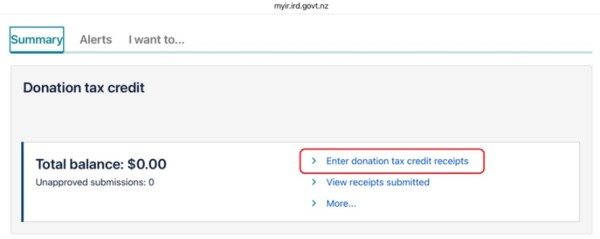

Under 'Accounts Summary', look for the 'Donation tax credit' option. Click this to begin the process.

2. Enter donation tax credit receipts

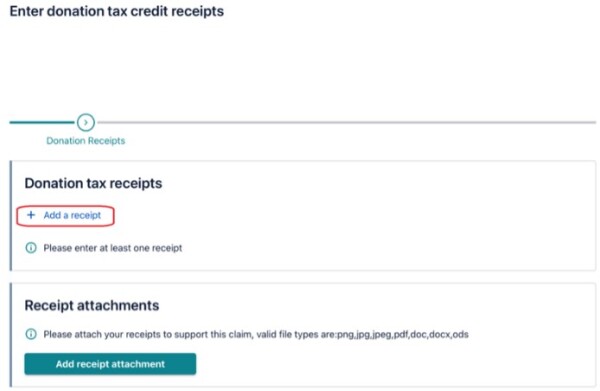

On the Donation tax credit page, select 'Enter donation tax credit receipts', then click 'Add a receipt'.

3. Select the organisation type

The form will ask for the type of organisation – religious, school, kindergarten, or other. Choose ‘Other’ for New Zealand Red Cross, then select 'Next'.

4. Attach your receipt

Click ‘Add receipt attachments’. If you have a physical copy, the IRD will accept a scan or a photo of the receipt. Select the type of attachment and add a description (e.g. 'Tax receipt 2024-2025').

5. Submit your claim

Once all required fields are filled, press 'OK'. A summary of your receipt will appear. If everything looks correct, press ‘Submit’. This will submit your claim to IRD.

1. Visit the IRD website to find the form

Go to www.ird.govt.nz. Under the search bar, click on the ‘Forms and Guides’ button.

2. Download the IR526 form

On the forms and guides page, select the IR526 form. Scroll down, click ‘Other ways to do this,’ then click ‘Download Form’ and print it.

3. Complete the form

Fill in the form with your details and attach your receipts.

4. Post your claim

Send the completed form and receipts to:

Inland Revenue

PO Box 39090

Wellington Mail Centre

Lower Hutt 5045